- 2.2Mtpa processing plant and other associated infrastructure to support activities

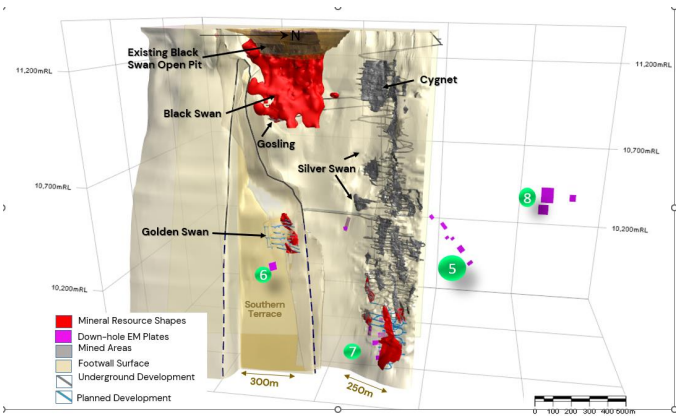

- Silver Swan underground Resource 12.9kt Ni at 8.8% Ni

- Golden Swan underground Resource 6.3kt Ni at 3.9% Ni

- Black Swan Disseminated open pit Resource 189kt Ni at 0.7% Ni

- Exploration targets remain prospective for additional high grade discoveries

History

The Black Swan Project is located approximately 600km east of Perth and 50km northeast of Kalgoorlie, Western Australia.

The project commenced operations in 1997 and operated continuously until 2008. The following production was achieved:

- Black Swan Open Pit - 5.9Mt @ 0.7% Ni for 41kt Ni

- Silver Swan Underground - 2.7Mt @ 5.1% Ni for 138kt Ni

- Total production 179kt Ni concentrate

The Company continues to progress toward a commencement of mining and processing operations at Black Swan when the nickel market is supportive of restarting following the completion of the 1.1Mtpa Bankable Feasibility Study. Work is progressing on a Pre-Feasibility Study for the 2.2Mtpa Expansion case.

2022 Black Swan Bankable Feasibility Study (BFS)

In November 2022 the Company released its Bankable Feasibility Study for the 1.1Mtpa mill feed option. The key points resulting from the completion of the BFS as follows:

- Mining and processing 1.1Mtpa of feed from Black Swan could deliver free cash flows of $333 million with a pre-tax NPV8 of $248 million and IRR 103% at the Australian dollar nickel spot used at the time of release

- Combined Black Swan Ore Reserves are 3.5Mt averaging 1.0% Ni for ~35kt contained nickel

- The Study assumes milling 5.0Mt of feed over four years to produce ~200kt concentrate containing ~30kt nickel

- Black Swan can produce a high-grade nickel concentrate with ~15% Ni, < 6% MgO and a Fe:MgO ratio of 5:1 which is highly desirable for conventional nickel smelters

- Estimated C1 unit cost of ~US$4.50/lb and All in Sustaining Costs of ~US$4.90/lb on a 100% payable basis (Ni in concentrate before smelter deductions)

- Existing infrastructure means a low pre-production capex of ~$50 million compared to a greenfields operation, which includes $38 million for refurbishment of the Black Swan concentrator

- Significant carried forward tax losses of up to $187 million could be utilised

- ESG focus embedded into the Feasibility Study process, carbon emissions reduced compared to 2018 Feasibility Study by accessing grid power

- The Company is progressing discussions with potential offtake and financing partners to achieve a Final Investment Decision (FID)

- Prefeasibility Study on the 2.2Mtpa Expansion case to produce a rougher concentrate is being updated and is subject to confirming payability assumptions.

EXPLORATION

A review undertaken by our exploration team in conjunction with geological consultants identified several exploration targets that warrant follow up.