Poseidon Nickel Limited (ASX Code: POS) is a nickel sulphide exploration and development company with three projects located within a radius of 300km from Kalgoorlie in the Goldfields region of Western Australia and a resource base of around 420,000 tonnes of nickel and 180,000 ounces of gold.

Poseidon owns three significant nickel assets with a combined resource of over 420kt of nickel and processing capacity of up to 3.7Mtpa of ore to produce nickel concentrate. The Company’s business strategy remains focussed on leveraging its existing asset base to grow Poseidon into a profitable and sustainable nickel producer.

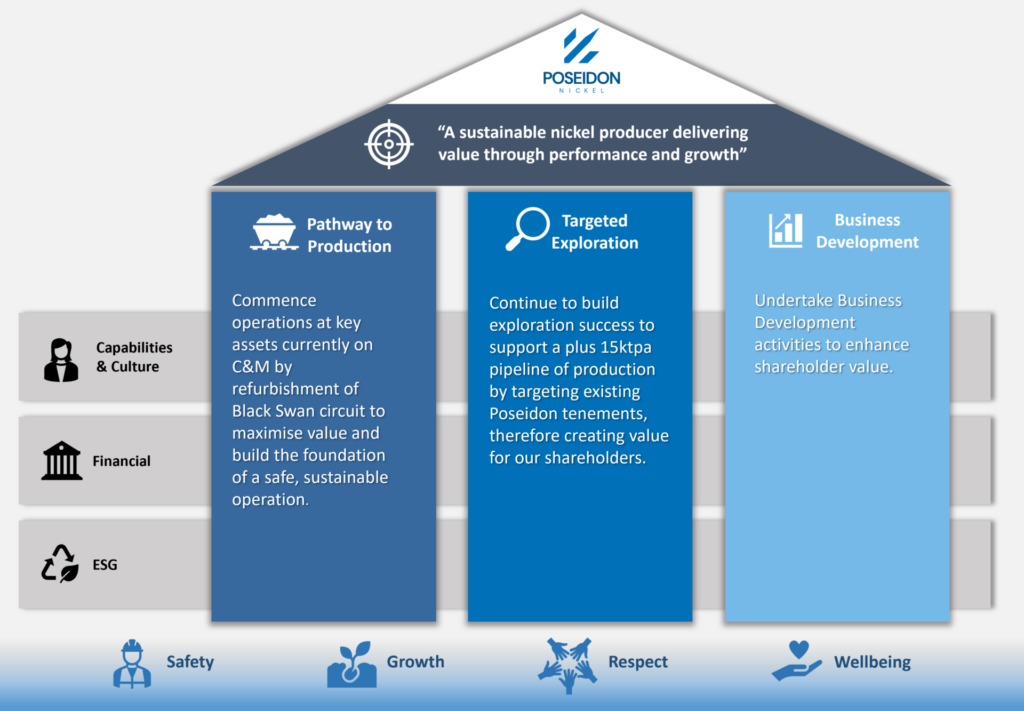

Poseidon’s strategic pillars are developing a pathway to production, targeted exploration across its nickel asset portfolio and considering proximal business development opportunities. The key enablers for the Company’s strategy to be successfully executed are ensuring key capabilities are resourced and the business is sufficiently funded for growth underpinned by a strong ESG framework.

Poseidon Business Strategy

The Company’s pathway to production was significantly progressed during FY22 with two metallurgical breakthroughs which could significantly improve the economics of the Black Swan project. The first involves incorporating a rougher concentrate regrind into its process flowsheet to significantly improve the quality of the smelter grade concentrate, which is expected to result in improved nickel payability. The second was testwork on a combined serpentinite and talc carbonate ore blend to produce a rougher concentrate which is amenable to both pressure oxidation and high-pressure acid leach to produce a mixed hydroxide precipitate the Expansion Project.

This culminated with the delivery of the Feasibility Study on the 1.1Mtpa project to produce high grade nickel concentrate suitable for conventional nickel smelters. Refer to ASX Release dated 21 November 2022 "Positive Black Swan Feasibility Study". The Company is now working with potential offtakers and project financiers with the aim of finalising an offtake and debt financing package.

The Company expects a more favourable environment for project development beyond 2023 when restarting the Black Swan project is feasible to do so.

With the assistance of geological consultants, the Company has completed exploration targeting reports for Black Swan, Lake Johnston and Windarra.

The Western Ultramafic Unit (WUU) at the Lake Johnston project has been identified as a priority target. Initial exploration activities have uncovered encouraging results which warrant further follow up activities.

The Windarra/Lancefield gold tailings project has been a focus for the Company to find a suitable development partner for the project. A number of companies have expressed interests in both the gold tailings and water resource available at South Windarra. Discussions are continuing with interested parties to agree to terms to add value to for our shareholders.