8 April 2024

Dear Shareholders,

There has been a lot going on at Poseidon these past few weeks with the announcement of the proposed sale of Lake Johnston to Mineral Resources (refer ASX release dated 18 March 2024) and then the leadership change with Brendan Shalders moving to the CEO role following Craig Jones's decision to move to a gold developer. Me and the rest of the Board look forward to working with Brendan as we pivot back to exploration, with a primary focus on the new targets at Windarra (refer ASX release 14 February 2024), while we wait for the nickel price to recover to a more sustainable level. The funds from the proposed sale of Lake Johnston will see the Company well funded for the foreseeable future.

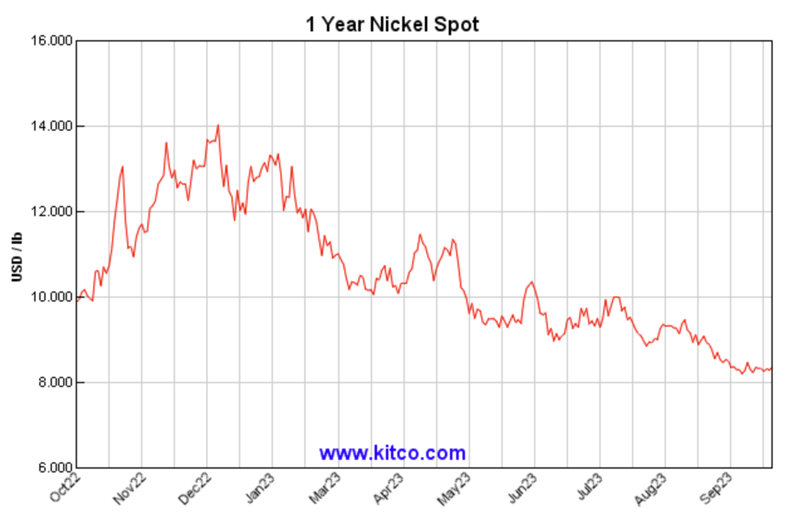

In 2023 we achieved the significant milestone with the release of the Black Swan Bankable Feasibility Study and made solid progress with offtake and debt funding. We had been moving steadily towards the Final Investment Decision for the Black Swan restart, however at the same time the nickel price was softening considerably (see chart below) and global equity markets became more volatile.

These factors, together with various project related items, lead us to make the decision in July 2023 to defer the Black Swan project restart. It is hoped that base metal prices and equity markets will start to recover in calendar year 2024 once the global interest rate tightening cycle peaks. This should provide a more favourable environment for the project’s restart.

In the meantime, we will continue to progress our strategic goals which are to:

- continue to move Black Swan forward towards production;

- increase resource and reserves through targeted exploration; and

- assess business development opportunities that enhance shareholder value.

While we remain committed to restarting Black Swan we are also progressing with the Black Swan Expansion Project Prefeasibility Study. The Expansion Project is based on mining both the serpentinite and talc carbonate ore from the open pit and producing a rougher concentrate with a 5-6% nickel grade and higher magnesium oxide content which could be processed via a high-pressure acid leach or pressure oxidation plant. The benefit of the Expansion Project is that the annual production of nickel concentrate would increase by operating the mill closer to the 2.2Mtpa nameplate capacity and the mine life could be extended due to the ability to treat talc carbonate material which is not included in the current ore reserves. The Prefeasibility Study for the Expansion Project is due for completion late 2023, subject to receiving confirmatory payabilities for the concentrate.

We are now focusing our exploration activities along the Western Ultramafic Unit at Lake Johnston after receiving some positive results earlier in the year. These results have enhanced the prospectivity at Maggie Hays West where an open-ended mineralised channel target up to 400m wide could exist, corresponding to a discrete magnetic feature. Compelling follow up targets have been generated and drilling commenced late in the September 2023 quarter to further define these targets and provide additional information ahead of us undertaking deeper drilling. Our geological team rate the potential for a new high-grade resource at Lake Johnston as high hence the reason for shifting our exploration efforts there for the foreseeable future.

Windarra has the gold tailings project, which looks much more attractive at current spot A$ gold price, a large nickel resource and a significant water inventory in the South Windarra pit, all of which are of interest to various parties. We are in discussions with a number of groups and will consider all proposals that can unlock value for our shareholders.

The decision to defer the restart of Black Swan meant we had to reduce costs. To do that we made some significant personnel changes to lower the corporate overhead while preserving the knowledge base of the Company. I transitioned from Managing Director to Non-Executive Chair, Craig Jones was appointed CEO while Derek La Ferla and Dean Hildebrand retired from the board. We also revised the care and maintenance operating model at Black Swan which has resulted in a material reduction in annual operating costs without impacting the restart timetable. Combined cost reductions from these initiatives total approximately $3 million on an annualised basis. These were not easy decisions to make, however they were necessary given the environment we are in.

We are well positioned to keep Black Swan moving towards a decision to proceed when the nickel price and equity market are more favourable and in the meantime we will continue to explore for more high-grade nickel resources.

I look forward to working with my fellow board members and the executive team to build on the work this team has already delivered.

Peter Harold

Non-Executive Chair